NE BUSINESS BUREAU

AHMEDABAD, NOV 18

Gold prices are expected to surge to Rs 65,000-67,000 per 10 gm on the domestic front in the long term and is likely to maintain the target of $2500 on the COMEX. The domestic gold futures (expiring on December 4) fell 0.81 percent to Rs 50,090 and silver futures dropped 2.5 percent to Rs 61,459 on November 11.

According to a recent commodity insight report by Motilal Oswal Financial Services, gold is being recommended to be collected with every dip towards Rs.49,500-48,500, a good range to buy with short-term upsides being capped around Rs.52,000-53,000.

According to the report, Comex Gold is expected to form a base around $1,880-1,840, while rallies are expected to be capped in the range of $1,940-$1,975. However, on the longer-term perspective, the target for gold is Rs 65,000-670,00 is maintained on the domestic front.

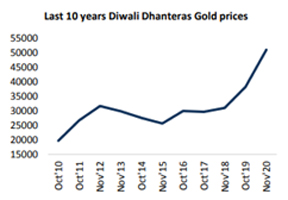

Gold’s performance in Diwali season

Over the last decade, gold in India has given a return of 159%. When compared to the equities, Dow Jones has given around 154% and the domestic equity index Nifty 50 has given 93% returns in the same period, which makes gold a star performer and particularly justifying the objective of protecting against inflation and depreciating rupee for Indian investors. Gold has performed very well till now on YoY basis. Except for the small dips in between, gold prices have not disappointed investors.

| Diwali Returns | |||

| 10 Yr | 5 Yr | 1 Yr | |

| Gold (MCX) | 159% | 99% | 33% |

| Nifty | 93% | 50% | 3% |

| Dow | 154% | 61% | 6% |

Source: Reuters

Central bank policies and Demand, Supply scenario for gold

Central banks cut interest rates and provided liquidity in the market to support the ailing economy. Global interest rates are currently near-zero level and are expected to remain low for some time. Fed Chairman in his past policy statement has mentioned that it might not go into negative territory w.r.t. interest rates, but keep these low levels till 2023. According to WGC, India’s gold demand in the fourth quarter is expected to recover after falling 30% in the previous quarter as festivals are expected to strengthen retail jewellery purchases. They expect Q4 would be better than Q3 due to pent-up demand and festivals.

Demand for the precious metal usually spikes towards the end of the year in India, as buying gold for weddings and major festivals such as Diwali and Dussehra is considered auspicious. As much we see an improvement in the overall sales and demand, the situation is not improving and the uncertainties hovering around the world has dented the physical gold market to some extent. There are two scenarios here, the impact of the pandemic and the lockdown situation is affecting the physical demand and on the other hand higher prices have forced investors to take some time before they start to accumulate, hence demand during the fourth quarter could be lower than the 194.3 tonnes recorded last year as consumers are struggling to adjust to near-record high prices. India’s gold demand in the first three quarters fell 49% from a year earlier to 252.4 tonnes as coronavirus-triggered lockdowns hit jewellery demand. While overall gold consumption fell, demand for coins and bars, known as investment demand, jumped 51% in the third quarter as rising prices attracted investors, keeping the sentiment high.

Gold’s performance and influencing factors

Gold in this year has touched an all-time high on both COMEX as well as on domestic bourses. The yellow metal consolidated after touching an all-time high of ~$2085 and ~Rs.56,400, with the overall uncertainties providing a strong floor at lower levels. A massive 40% return in just half a year supported by strong fundamentals gives a boost to the metal is a very attractive scenario for the metal. Prices gained at the start of the year as investors worried about the impact of a trade war between the US and China, Central banks accommodative stance & stimulus measures, excess liquidity, Covid-19 relief bill, lower bond yields, but now the Impact of the pandemic and updates regarding the US Presidential election in the recent past has forced market participants to take a cautious approach. All these factors along with volatility in Rupee have impacted the domestic prices.

Outlook

A significant price rally is witnessed this year triggered by the uncertainties hovering in the market, the impact of the pandemic, and also a depreciating rupee. Coming a few months after the US Presidential election will be very important to define gold’s short to medium-term trajectory. Central bank’s stance, low-interest rates, and yields, the spillover effect of excess liquidity in the market, impact of the pandemic, and other concerns could set a perfect picture for a gold rally in the long term. The pace of the rally could depend on the updates on the US Presidential election, Covid relief bill, development in the pandemic numbers and its vaccine, and few other factors although sentiments do look positive for this Diwali too, keeping the hopes high for bullion.