MUMBAI, JAN 21

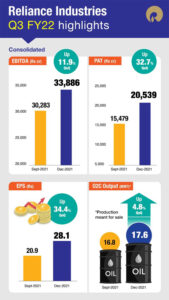

Reliance Industries Ltd, the largest Indian company based on market capitalisation, on Friday reported 42% jump in consolidated net profit at Rs 18,549 crore for the quarter ending December 31, 2021 boosted by strong performance in its oil-to-chemicals and retail businesses. The company reported consolidated net profit of Rs 13,101 crore a year ago.

Consolidated revenue from operations rose 54% to Rs 1.91 trillion as against Rs 1.24 trillion a year ago.

“I am happy to announce that Reliance has posted best-ever quarterly performance in 3Q FY22 with strong contribution from all our businesses. Both our consumer businesses, retail and digital services have recorded highest ever revenues and EBITDA. During this quarter, we continued to focus on strategic investments and partnerships across our businesses to drive future growth,” Reliance Industries chairman Mukesh Ambani said.

The company reported an EBITDA (earnings before interest, tax, depreciation and amortisation) at Rs 33,886 crore during the third quarter, higher by as much as 30%.

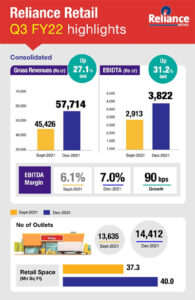

Retail business activity has normalized with strong growth in key consumption baskets on the back of festive season and as lockdowns eased across the country. Our digital services business has delivered broad based, sustainable, and profitable growth through improved customer engagement and subscriber mix, he said.

The net profit figure for the previous quarter stood at Rs 13,680 crore with the company registering consolidated revenues of Rs 1.7 trillion.

Reliance Jio Infocomm’s net profit rose 10% to Rs 3,615 crore in Q3FY22 as against Rs 3,291 crore in Q3FY21.

Reliance Jio Infocomm’s revenue from operations increased 5% to Rs 19,347 crore as againt Rs 18,492 crore in year-ago period.

Jio’s average revenue per user (ARPU), a key performance metric, improved 8.4% to Rs 151.6, partly helped by a tariff hike towards the end of the quarter.

The full impact of the tariff hike would likely be reflected in ARPU and financials over the next few quarters, said Kiran Thomas, Director, Jio Platforms, in a conference call.

Reliance’s retail business rode a boom in consumer demand, with the lifting of most COVID-19 restrictions toward the end of 2021, while higher refining margins and improved price realizations bolstered its mainstay energy business. The retail segment revenue jumped more than 52% to Rs 57,717 crore.

Reliance recorded a one-off gain of Rs 2,872 crore from the sale of its shale gas assets.

The conglomerate’s outstanding debt is Rs 2.45 trillion as on December 31. RIL said it expects production from MJ field in KG D6 blog in east coast in Q3FY23.