NE BUSINESS BUREAU

NEW DELHI, OCT 16

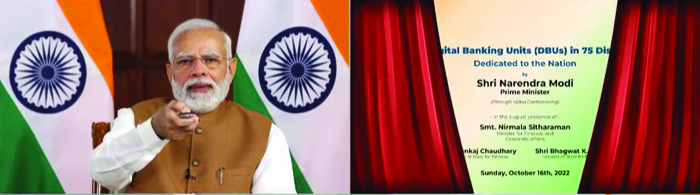

Prime Minister Narendra Modi dedicated 75 Digital Banking Units (DBU) across 75 districts to the nation via video conferencing on Sunday. Addressing the gathering, the Prime Minister started by stressing that the 75 Digital Banking Units (DBU) will further financial inclusion and enhance banking experience for citizens. “DBU is a big step in the direction of Ease of Living for the common citizens,” he said.

The 75 Digital Banking Units will further financial inclusion & enhance banking experience for citizens. https://t.co/gL4lEE6b7d

— Narendra Modi (@narendramodi) October 16, 2022

The Prime Minister informed that in such a banking setup, the government aims to provide maximum services with minimum infrastructure, and all of this will happen digitally without involving any paperwork. It will also simplify the banking procedure while also providing a robust and secure banking system. “People living in small towns and villages will find benefits like transferring money to availing loans. Digital Banking Units are another big step in that direction which is going on in the country to make the life of common man of India easier,” he added.

- Today the number of branches per one lakh adult citizens in India is more than countries like Germany, China and South Africa: Modi

- Deploying technology to achieve development goals is a hallmark of our Government, says Sitharaman

- DBUs an enabler in digital ecosystem, to improve customer experience by facilitating seamless banking transactions: RBI Governor

The Prime Minister said that the aim of the government is to empower the common citizen and make them powerful, and as a result, policies were made keeping in mind the last person and the entire government moving in the direction of their welfare. He pointed out the two areas on which the government worked simultaneously. First, reforming, strengthening, and making the banking system transparent, and secondly financial inclusion.

Virtual launch of Digital Banking Units (DBU) by PM https://t.co/CiruA4N931

— ReserveBankOfIndia (@RBI) October 16, 2022

Recalling the traditional ways of the past where people had to go to the bank, the Prime Minister said that this government transformed the approach by bringing the bank to the people. “We have given top priority to ensure that banking services reach the last mile,” he said. A huge change from the days when it was expected that poor will go to the bank to a scenario when the banks were going on the doorstep of the poor. This involved reduction of distance between the poor and the banks. “We not only removed the physical distance but, most importantly, we removed the psychological distance.” Highest priority was given to cover far flung areas with banking. The Prime Minister informed that today more than 99 percent of villages in India have a bank branch, banking outlet or a ‘banking mitra’ within 5 km radius. “Extensive Post Office network too was harnessed via India Post Banks for providing the banking needs to the common citizens”, he said. “Today the number of branches per one lakh adult citizens in India is more than countries like Germany, China and South Africa”, he added.

Despite initial misgivings in certain sections, the Prime Minister said, “today the entire country is experiencing the power of Jan Dhan Bank accounts.” He informed that these accounts enabled the government to provide insurance to the vulnerable at a very low premium. “This opened the way for loans for the poor without collateral and provided Direct Benefit Transfer to the accounts of the target beneficiaries. These accounts were the key modality for providing homes, toilets, gas subsidy, and benefits of schemes for farmers could be ensured seamlessly”, he said. The Prime Minister acknowledged the global recognition for India’s digital banking infrastructure. “The IMF has praised India’s digital banking infrastructure. The credit for this goes to the poor, farmers and labourers of India, who have adopted new technologies, made it a part of their lives”, he emphasised.

In her address on the occasion, Union Minister for Finance & Corporate Affairs Nirmala Sitharaman said that during Amrit Kaal, honourable Prime Minister, honouring your vision for greater use of technology and getting digital banking into India, the Scheduled Commercial Banks are establishing 75 Digital Banking units (DBUs) in 75 districts of our country.

Sitharaman, while participating in the launch via video conference from Washington DC, said that DBUs will enable people who do not have a personal computer, who do not have a laptop, or do not have even a smartphone, to be able to access banking services. They can do it digitally in a paperless mode. For those who are not even tech savvy, there is a mode where they can be facilitated to avail of these paperless services.