NE BUSINESS BUREAU

MUMBAI, OCT 21

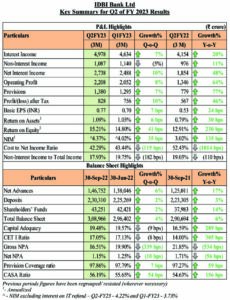

Private sector lender IDBI Bank on Friday reported a whopping 46 percent rise in its net profit to Rs 828 crore for the second quarter ended September 30. The bank had posted a net profit of Rs 567.12 crore in the year-ago period.

The total income in the September 2022-23 quarter rose to Rs 6,065.51 crore from Rs 5,129.92 crore a year ago, an IDBI Bank release said.

The private sector lender, controlled by India’s largest insurer Life Insurance Corporation (LIC), improved its asset quality by bringing down its gross non-performing assets (NPAs) to 16.51 percent of the gross advances as of September 30, 2022, against 21.85 percent at the end of September 2021.

The Bank’s net NPAs too came down to 1.15 percent from 1.71 percent.

However, the provisioning towards bad loans and contingencies for the September quarter of of FY23 was raised to Rs 770.72 crore from Rs 571.43 crore in Q2 FY22. It was lower than Rs 959.23 crore for June 2022-23 quarter.

The bank’s CASA increased to Rs 1,29,407 crore as on September 30, 2022 as against Rs 1,21,995 as on September 30, 2021 (YoY growth of 6%). CASA stood at Rs 1,25,356 crore as on June 30, 2022. The share of CASA in total deposits improved to 56.19% as on September 30, 2022 as against 54.63% as on September 30, 2021 and 55.65% as on June 30, 2022.

The net advances grew by 17% YoY to ₹1,46,752 crore as on September 30, 2022.

The composition of corporate v/s retail in gross advances portfolio was at 35:65 as on September 30, 2022 as against 37:63 as on June 30, 2022.

Key Summary for Q2 of FY 2023 Results