- Says allegations are no more than’ red herrings’ thrown by desperate entity with total contempt for Indian laws

- Buch and her husband said the US shortseller’s claims are devoid of any truth and pointed out that all disclosures were already furnished to Sebi

NE BUSINESS BUREAU

AHMEDABAD, AUGUST 11

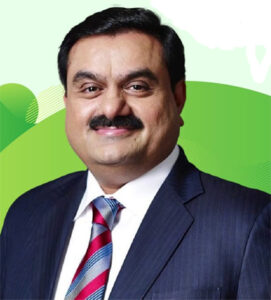

The Adani Group on Sunday came down heavily on the US short-seller Hindenburg Research and called itslatest allegations as ‘malicious and manipulative of select public information,’ saying it has no commercial relationship with the Sebi Chairperson or her husband. It said the allegations are “no more than red herrings” thrown by a desperate entity that flouts Indian laws.

“The latest allegations by Hindenburg are malicious, mischievous and manipulative selections of publicly available information to arrive at pre-determined conclusions for personal profiteering with wanton disregard for facts and the law. We completely reject these allegations against the Adani Group which are a recycling of discredited claims that have been thoroughly investigated, proven to be baseless and already dismissed by the Hon’ble Supreme Court in January

Adani Group said its overseas holding structure is fully transparent and all relevant details were disclosed regularly through documents that were made public.

The company said it has absolutely no commercial relationship with the individuals or matters mentioned in the Hindenburg report.

Adani Group’s statement comes after Sebi Chairperson Madhabi Puri Buch and her husband Dhaval released a joint statement, denying the allegations levelled against them by Hindenburg Research.

Pointing out that their life and finances are an open book, the couple called the allegations “baseless”. They said it is unfortunate that the US short seller is opting for character assassination after Sebi issued a show cause notice against the company.

Citing whistleblower documents, the short seller accused the Sebi chief and her husband of having stakes in obscure offshore entities where significant amount of money was invested by Gautam Adani’s brother Vinod’s associates.

The New York company also claimed that the Sebi has shown a surprising lack of interest in Adani’s alleged web of offshore shell entities.

Buch and her husband said the US shortseller’s claims are devoid of any truth and pointed out that all disclosures were already furnished to Sebi.

They said they have no inhibtion in furnishing their financial documents to the authorities, adding that they will issue a detailed statement later to ensure transparency.