NE BUSINESS BUREAU

MUMBAI, AUG 20

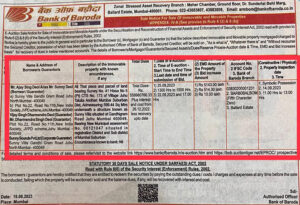

Public sector lender Bank of Baroda has put on the block a property owned by actor and sitting BJP Member of Parliament Sunny Deol to recover Rs 56 crore through an e-auction to be held on August 25.

Following the same, Sunny’s spokesperson released a statement that read, “We are in process of resolving this issue and the auction will be called off. We request no further speculation on the same.”

- We are in process of resolving this issue and the auction will be called off: Sunny’s spokesperson

- The bank has fixed the reserve price for the auction at Rs 51.43 crore and an earnest money deposit of Rs 5.14 crore

The Gurdaspur MP, whose latest flick Gaddar 2 is a box office success having already grossed over Rs 300 crore since the release last week, has been in default on a Rs 55.99 crore loan from the bank and interest and penalty, since December 2022, the second largest state-owned lender said in a public tender on Sunday.

The bank, which has attached the property, Sunny Villa located on the Gandhigram Road in the tony Juhu area of the megapolis, has fixed the reserve price for the auction at Rs 51.43 crore and an earnest money deposit of Rs 5.14 crore.

Apart from the Sunny Villa, the 599.44 square metre property also houses Sunny Sounds, which is owned by the Deols, and is the corporate guarantor to the loan, while his actor-politician father Dharmendra is the personal guarantor of the debt, according to the auction notice.

The notice for auction was put up by the Bank of Baroda in a national newspaper on Sunday, August 20. It mentions the ‘Gadar 2’ star’s real name, Ajay Singh Deol, the fact that his Juhu villa is named Sunny Villa and other loan details. Sunny Deol’s brother Bobby Deol, whose real name is Vijay Singh Deol, their father Dharmendra Singh Deol, and Sunny Deol’s company Sunny Sounds Pvt Ltd are named as Guarantors and Corporate Guarantor for the loan that he had borrowed from Bank of Baroda.

The tender notice further said the Deols still have the option of clearing the dues to the bank to prevent the auction to be carried out under the provisions of the Sarfaesi Act of 2002.

As per the rules, a loan becomes a non-performing asset (NPA) if the repayment of interest is abset as well as the principal for 90 days. Banks are required to set aside money to cover the likely losses from such loans and they usually auction such properties to recover the amount.