NE BUSINESS BUREAU

AHMEDABAD, JUNE 4

The 84th Business Inflation Expectations Survey (BIES) of the Indian Institute of Management-Ahmedabad (IIMA) revealed that the companies’ inflation expectation in the current round of April 2024.

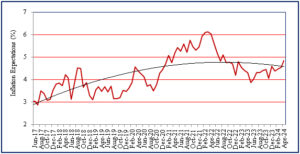

“One year ahead business inflation expectation, as estimated from the mean of individual probability distribution of unit cost increase, has increased sharply by 29 basis points to 4.84% in April 2024 from 4.55% reported in March 2024. Firms’ inflation expectation in the current round is the highest in the past 22 months. Around 48% of the firms in April 2024 are reporting profit margins to be ‘about normal’ or greater – up from 42% reported in March 2024,” says the survey

The uncertainty of business inflation expectations in April 2024 as captured by the square root of the average variance of the individual probability distribution of unit cost increase, declined sharply to 1.86% from around 2.1% reported during January-March 2024.

Chart 1: One year ahead business inflation expectations (%)

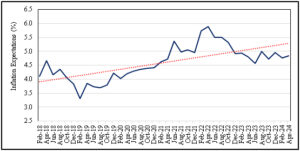

Respondents were also asked to project one year ahead CPI headline inflation through an additional question using a probability distribution. This question is repeated every alternate month, coinciding with the month of RBI’s bi-monthly monetary policy announcement.

Businesses in April 2024 expect one year ahead CPI headline inflation to be 4.83%, marginally up by 6 basis points from 4.77% reported in February 2024 (Chart 2). However, their uncertainty of expectations has declined to 0.92% in April 2024, from 1.06% reported in February 2024.

Chart 2: Expected CPI headline inflation (%) – one year ahead

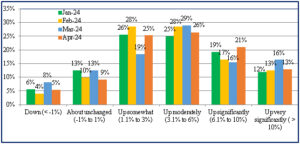

The cost perceptions data in April 2024 indicate increase in cost pressures. The percentage of firms perceiving significant cost increase (over 6% to 10%) in April 2024 has increased sharply to 21%, from around 16% reported in March 2024. The percentage of firms reporting moderate cost increase (3.1% to 6.0%), on the other hand, has declined to 26% in April 2024, from 29% reported in March 2024.

Chart 3: How do current costs per unit compare with this time last year? – % responses

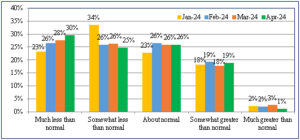

The sales expectations scenario during February-April 2024 remained similar. Around 18-19% of the firms are reporting ‘somewhat greater than normal’. About 55% of the firms are still reporting ‘somewhat less than normal’ or lower sales during March-April 2024.

Chart 4: Sales Levels – % response

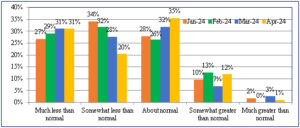

Around 48% of the firms in April 2024 are reporting profit margins to be ‘about normal’ or greater – up from 42% reported in March 2024. Overall, the profit margins expectations have improved in April 2024.

Chart 5: Profit Margins – % response

The BIES survey provides ways to examine the amount of slack in the economy by polling a panel of business leaders about their inflation expectations in the short and medium term. This monthly survey asks questions about year-ahead cost expectations and the factors influencing price changes, such as profit, sales levels, etc. Companies selected for the survey are primarily from the manufacturing sector.