NE BUSINESS BUREAU

AHMEDABAD, APRIL 27

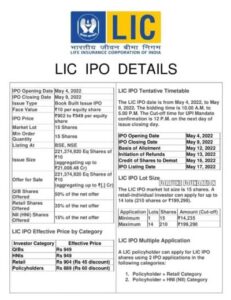

All eyes are on the LIC IPO as the company has shared details on its issue. The LIC IPO is set to open on May 2 for anchors and on May 4 for subscription. The IPO will see a 3.5% stake in LIC to raise Rs 21,000 crore with a price band of Rs 902 to Rs 949.

LIC is ubiquitous as the biggest insurance company in India and being a brand name recognised in every household, numerous retail investors are likely to subscribe to the issue. And Paytm Money CEO Varun Sridhar believes that this IPO will result in the greatest month for Indian capital markets.

Given that LIC policyholders will also receive a ₹60 discount while employees and retail investors will get a ₹45 discount, we may see many new investors from smaller cities and towns also opening their demat accounts only to apply for the LIC IPO.

“With the LIC IPO coming up, we believe that May will be a record month for demat account openings in recent times. It is a milestone event for Indian Capital markets and is expected to bring millions of new investors. We at Paytm Money are excited for this opportunity as we have built one of the most robust and comprehensive trading and investment platforms in the country. More importantly, given the trust that LIC has built with the common man over the decades, a lot of these investors are expected to come from tier 2 & 3 towns. Our IPO product will allow these new retail and HNI investors to apply for the IPOs on the Paytm Money and Paytm app in a breeze,” said Varun Sridhar, CEO – Paytm Money.

New retail investors looking to understand further about LIC IPO and its impact on the capital markets, can also access detailed IPO reports, application statistics, and a host of live events on Paytm Money app to help decide whether they want to participate in the IPO and how much to invest.