R ARIVANANTHAM

CHENNAI, JUNE 15

The Pension Fund Regulatory and Development Authority (PFRDA), has on Friday announced launching Balanced Life Cycle (BLC) fund during the second quarter of this financial year said its Chairman Deepak Mohanty.

Addressing reporters he said the Balanced Life Cycle fund is an additional investment avenue with the enhanced equity exposure. The flexible low-cost regulatory scheme will have equal share of 50 % of equity and debt, he added.

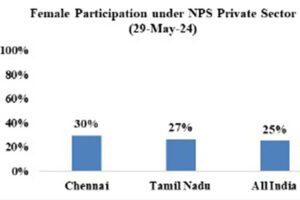

- Chennai in Tamil Nadu has 30% women subscribers against the national average of 25 per cent, it is due to larger participation of women in the workforce

- NPS subscribers can withdraw a maximum 60% of pension money as lumpsum and the remaining 40% must be mandatorily used for buying annuity and they continues to stay with annuity funds until the age of 75.

The National Pension System (NPS) and Atal Pension Yojana (APY) has crossed 12.3 lakh crore subscribers and it has been targeted to reach 15 lakh crore subscribers during the current fiscal.

PFRDA Chairperson said that a total number of employees covered under the NPS Scheme is 92 lakh across the nation. Out of this, 56 lakh are from private sector, PSUs and individuals.

30% of NPS subscribers in Chennai are women against the national average of 25%

Replying to queries he said, Mr Mohanty said Chennai in Tamil Nadu has 30% women subscribers against the national average of 25 per cent, it is due to larger participation of women in the workforce, he said. He said that a total of 16,000 corporates (both public and private) have joined the NPS but the take up rate among the corporate employees is not that high and PFRDA is increasing awareness so that more corporate employees join NPS.

Mohanty said in Tamil Nadu 2,500 corporates have taken to the NPS system. These include 4 lakh private sector employees.

NPS subscribers can withdraw a maximum 60% of pension money as lumpsum and the remaining 40% must be mandatorily used for buying annuity and they continues to stay with annuity funds until the age of 75.

When asked about the penetration of NPS in rural areas, he said PFRDA will undertake multimedia campaign through various modes. Individuals can open an NPS account with a minimum of Rs. 500 and they can remit whenever they have excess funds in their hands, he added.