NE BUSINESS BUREAU

AHMEDABAD, MAY 27

Wondering what are Super Funds and whether you should invest in them?

PhonePe offers a quick explainer.

Kya Mutual Fund aapke liye sahi hai?

Is all the talk about Mutual funds confusing you? It’s quite simple really.

There are three main kinds of Mutual funds:

1) Equity Funds invest in the stock market and are considered high risk but they also come with higher return.

2) Debt Funds invest in bonds issued by the Government (Gilts), or by Corporates including banks and are typically lower risk and steady returns.

3) Hybrid Funds invest in both equity and debt instruments and they come with moderate risk and return.

What are Funds of Funds and how do they work?

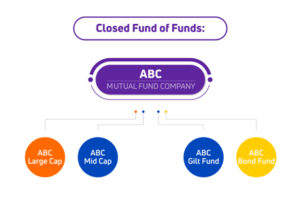

Fund of Funds (FOF) invest in multiple funds and aim to give investors more flexibility and higher return. However, most Mutual Fund Companies offer a Closed Fund of Funds which means they restrict themselves to choosing funds from their own Company. Typically Mutual Fund Companies may be strong in some areas, but weak in some other areas. This restricts the ability of the FOF to choose the best fund from each category.

Enter Open Super Funds!

Super Funds pick the best funds from different Fund Houses and therefore they can overcome the shortcomings of a single company Fund of Fund. For example, Aditya Birla Sunlife (ABSL) may be very strong in Equity and Axis Mutual Fund might be strong in Debt, so it makes sense to choose the best Equity fund from ABSL and the Best Debt fund from Axis to create the best Open Fund of Funds.

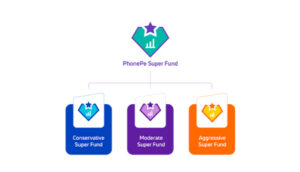

Super se bhi upar: Super Funds on PhonePe

The Super Fund solution on PhonePe chooses the best funds from different Mutual Fund Companies, and also offers three different options namely Conservative Fund, Moderate Fund and Aggressive Fund so that you can choose the best possible risk and return combination.

Super Funds on PhonePe thus stand out in following ways

- It is a simple and comprehensive solution where you just need to decide the right Super Fund for you based on your risk appetite and leave the rest to Expert Fund Managers, who will choose the appropriate funds to invest and decide the proportion of investment in each Fund based on the Super Fund that you choose.

- The expert fund managers will continuously monitor the investments and if necessary, will make changes in allocation across different funds in the portfolio depending on market environment and consistency of underlying funds, that too in a tax efficient way. This provides a big relief for investors who find it difficult to choose the right funds for investing and track those funds on an ongoing basis.

- Super Funds follow an open architecture fund of funds structure with investments in different mutual fund companies with an endeavour to choose consistent schemes across AMCs and to diversify across fund manager styles.

- Super Funds have redefined the ‘affordability’ benchmark in mutual funds as investors now can invest in a solid portfolio of mutual funds schemes with as little as ₹ 500. Thus even a small investor will now have access to a superior long-term investment solution.

- Super Funds are ideal for long-term investment of over 3 years and if the investment is held for more than 3 years, they enjoy indexation benefits which makes them quite tax-efficient compared to traditional investments such as bank fixed deposits and almost at par with equity funds.