NE BUSINESS BUREAU

NEW DELHI, MUMBAI, MARCH 27

From Prime Minister Narendra Modi to rating agencies, industry captains and economists, all welcomed the Reserve Bank of India’s steps to reduce the cost of borrowing and infusing liquidity in the market in its war against the impact of coronavirus pandemic. Following are the comments made by key leaders, businessmen and economists:

Today @RBI has taken giant steps to safeguard our economy from the impact of the Coronavirus. The announcements will improve liquidity, reduce cost of funds, help middle class and businesses. https://t.co/pgYOUBQtNl

— Narendra Modi (@narendramodi) March 27, 2020

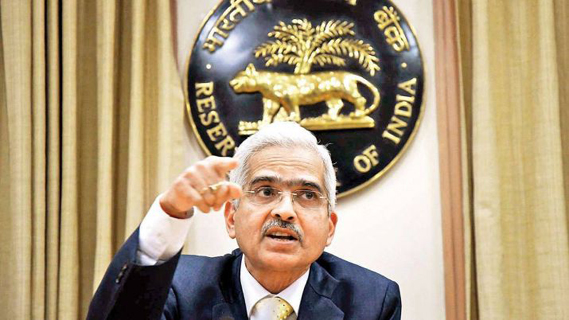

* Finance Minister Nirmala Sitharaman: Appreciate RBI Governor Shaktikanta Das’ reassuring words on financial stability. The 3-month moratorium on payments of term loan installments (EMI) and interest on working capital give much-desired relief. The slashed interest rate needs quick transmission.

* Alka Anbarasu of Moody’s Investors Service: RBI’s guidelines permitting banks and non-bank financial institutions to grant a 3-month moratorium on loan repayments will soften the negative credit impact that the coronavirus has had on their borrowers in the near term. However, there are still material downside risks to asset quality given the halt in India’s economy, the impact of which will not be known until a few quarters after the end of the moratorium.

* SBI Chairman Rajnish Kumar: The RBI policy announcements are bold, decisive, compelling and with a humane touch in attenuating to the needs of the economy to fight through the pandemic. The large rate cut, the adjustment in capital conservation buffer, the moratorium on repayments and the bazooka of conventional CRR cut and unconventional liquidity measure of incentivising banks to support CP market – all will help financial markets stabilise, lead to immediate rate transmission and address the credit needs of the real economy. Given that we are in exceptional times, RBI has played the role of championing the cause for the economy and financial system!

* Cyril Shroff, Managing Partner, Cyril Amarchand Mangaldas: The RBI has unleashed a bazooka to deal with the economic pain and uncertainty prevailing. This provides a much-needed respite for borrowers and lenders in these trying circumstances and should soften the recovery period.

* BJP president Jagat Prakash Nadda: RBI decision will help the middle class. I welcome these progressive and timely measures.

* Oil Minister Dharmendra Pradhan: Moratorium on payment of interest on loans and working capital will provide much-needed relief to both people and businesses.

* Raymond Ltd chairman and managing director Gautam Hari Singhania: The moves announced by RBI today are decisive and a comprehensive package to ensure the stability of financial markets making borrowing costs as low as possible with businesses around the country are closed and the economy is showing recessionary trends. The steps to ease working capital pain, reduced liquidity costs and providing moratorium on term loans will alleviate stress across various sectors.

* Essar Ports CEO Rajiv Agarwal: Moratorium of 3 months for interest and principle payments along with a sharp cut in the CRR will ease the liquidity and help industry as well other segments of the economy. More steps might be needed once the Government comes out with the much-needed stimulus package to overcome the economic crisis arising from COVID-19.

* Anshuman Magazine, CBRE: RBI is in a mission mode to nurture the market, preserve financial stability and the timing here is crucial. The decision to defer installments of all term loans by three months will provide the necessary support to homebuyers as well.

* Arun Singh, Chief Economist, Dun and Bradstreet: Strong proactive measures have been taken by RBI to address the need of the country in times of heightened uncertainty. Such robust measures were unanticipated and would restore the confidence of the market, restrict foreign capital outflows, both in the debt and equity market, and will help in arresting depreciation of rupee. Mitigating debt servicing burden to prevent transmission of financial stress to the real economy was much needed as various countries globally have deferred loan payments from three to six months. However, banks might face difficulties meeting the capital adequacy norms which we expect will be further relaxed by the RBI during the short term.

* Gayathri Parthasarathy, KPMG: It is a good decision and the time is right for RBI to intervene and announce these measures. The steps to ease working capital pain, reduce liquidity costs and provide a moratorium on term loans will alleviate stress across various sectors. Liquidity will definitely help the current situation and I strongly believe the rates could go down further by 50 to 75 basis points.

* Sanjay Doshi, KPMG: Onus is now on the financial institutions to ensure better credit support to the corporate. However, given the challenging times, many corporates will have significant pressure on their income stream. Banks will have a tough job in deciding the allocation of credit.

* Muthoot Pappachan Group Chairman Thomas John Muthoot: Various measures to nudge banks to lend and to inject liquidity into the system, will help in passing the benefit to the potential borrowers.

* Radhika Rao, Economist, DBS Group Research: RBI pulled all the stops, delivering an aggressive rate cut. Its moves provide the right tailwind for the economy once the lockdown is complete.

* Nirmal Jain, Chairman, IIFL Group: Liquidity booster, rate cut, and the moratorium is a complete package for the time being. The government needs to take measures to revive demand as soon as the lockdown is lifted. RBI does whatever it takes to make banks, markets Covid-19 resistant.

* Abhimanyu Sofat, Head of Research, IIFL Securities: RBI announced a bold set of measures amounting to 3.2% of GDP to fight coronavirus will be well taken by the market. Measures of no asset classification downgrade for 3 months on term loans, working capital loans moratorium will be a relief for the industry. Providing liquidity in investment-grade corporate bonds will help in improving the currently stalled credit markets. Additionally, CRR cut of 100 bp along with repo and reverse repo cuts are likely to help induce additional liquidity.

* Ajoy Chawla, CEO Jewellery Division, Titan Company Limited: We support the government’s decision in the interest of public health and as responsible citizens, we must suppress the spread of the virus. Jewellery, as an industry is grappling with zero cash flows due to this closure.

* R.K.Gurumurthy, Head – Treasury, Lakshmi Vilas Bank: A cut in the Repo Rate by 75 basis points to 4.40% (previous low was the 2004 4.50%), widening of the corridor and therefore the Reverse Repo rate now is fixed at 4%, 40 basis instead of 25 basis so far below the Repo Rate). CRR cut by 100 basis points and at 3%, this is at the lowest in about 60 years. The CRR cut alone is expected to release 1.37 trillion rupees into the system immediately. This will also increase the profitability of banks. Also, the RBI has this time announced a targeted LTRO where the funds raised under the scheme will be allowed to have an end-use of buying corporate bonds and Commercial Papers. And these can be held under the HTM category. This will provide the much-needed shot-in-the-arm for the non-SLR market in terms of liquidity support. MSF, an emergency funding tool, is now increased to 3% of NDTL. The combined liquidity effect of the changes to LTRO, CRR Cut and MSF will bring in 3.75 trillion rupees into the system.

* Zarin Daruwala, CEO, India, Standard Chartered Bank: The bold steps initiated by the Monetary Policy Committee should help financial markets tide over the current situation. The 100 bps Cash Reserve Ratio (CRR) cut along with the 75bps repo rate cut and additional liquidity under the marginal standing facility (MSF), will free up precious term liquidity to augment the government’s fiscal efforts. The 3-year targeted long term repo operations (TLTRO) will decongest credit channels and low- the cost of credit, providing much-needed relief to corporates.

* Vijay Chandok, MD & CEO, ICICI Securities: The RBI has gone all out to fight the economic fallout of Covid-19. Although the rate cut is big, we believe the economy will benefit more from the liquidity and regulatory actions. The RBI has pumped liquidity into the system through targeted long term operations and CRR cut. They have also taken a series of measures to nudge banks to lend to the productive sectors of the economy. Moreover, regulatory measures such as relaxing debt servicing burden and working capital financing until June 2020 are likely to help businesses during this crisis.

* Amar Ambani, Senior President and Head of Research, YES Securities: The RBI policy has done everything in its power to help the Indian economy fight the slowdown, emanating from the Covid-19 crisis. The Central bank has effectively cut rates in the system by over 100 basis points if one were to consider the combined benefit of the repo cut, sharp reverse repo cut, easing of CRR requirement, reduced need of daily CRR balance and MSF facility. This potent combination will result in immediate monetary transmission of these measures. All-in-all, the liquidity injected in the system would be to the tune of $50bn. Among other steps, banks are now being allowed to participate in NDF market, a long-standing demand, that will help tide over the currency volatility somewhat.