NE BUSINESS BUREAU

CHENNAI, JAN 20

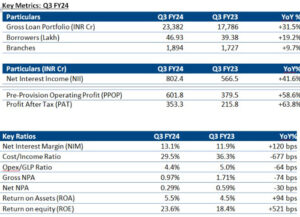

Bengaluru-based NBFC-MFI CreditAccess Grameen posted a net profit of ₹353.3 crore in Q3 FY24, up 64 per cent on year, led by strong growth of 42.4 per cent in total income to ₹1,295.2 crore.

“Our profitability milestone touched a new mark as we recorded a PAT of ₹1,049 crore for 9M FY24, higher than the PAT of ₹826 crore for FY23. We completed a major technology project of upgrading our core banking solution (CBS), enabling significant business scalability and making us future-ready,” Udaya Kumar Hebbar, Managing Director, said.

“As of Dec-23 end, the share of bank borrowings stood at 50.4% while foreign borrowing was at 21.5%. We maintained a healthy positive ALM mismatch with the average maturity of assets at 18.7 months and the average maturity of liabilities at 24.4 months. We have always believed that the quality of the lending business is equally determined by the quality of the liability franchise for achieving a sustainable growth path,” added Uday Kumar Hebbar.

Gross loan portfolio grew 31.5 per cent yoy to ₹23,382 crore. The borrower base grew 19.2 per cent on year to 46.93 lakh across 1,894 branches. The MFI added 14.86 lakh customers in the past one year, of which 44 per cent were from outside the top 3 states.

Net interest income (NII), the difference between the interest income and the interest the bank pays to depositors, increased 41.6 per cent yoy to ₹802.4 crore. Net Interest Margin (NIM) for the quarter was 13.1 per cent up 120 bps on year.

The share of bank borrowings stood at 50.4 per cent, while foreign borrowing was 21.5 per cent.

Impairment of financial instruments increased 41.1 per cent to ₹126.2 crore. Total ECL provisions for the quarter were ₹410.7 crore. The lenders wrote off loans worth ₹58.7 crore.

Collection efficiency stood at 98.3 per cent as of December 2023. Gross NPA ratio improved to 0.97 per cent from 1.71 per cent a year ago, whereas net NPA ratio at 0.29 per cent was better than 0.59 per cent in the previous year.