NE BUSINESS BUREAU

AHMEDABAD, APRIL 25

ACC Limited (ACC), the most trusted legacy brand and one of India’s largest Cement and Building materials company of the diversified Adani Group, on Thursday announced robust results for Q4 and full year ended March 31, 2024. The improved performance is attributed to all round improvement in volume, cost and efficiency parameters.

- Annualised PAT (12 months) at Rs. 2,337* Crores up 378 % YoY

- Q4 Operating EBITDA up by 79% at Rs. 837 Crores

- Healthy Cash & Cash equivalent at Rs. 4,667 Crores

- Volume up by 23.5%, revenues up 13% YoY

- EBITDA (PMT) at Rs. 802 PMT, up 45% YoY

- EBITDA margin at 15.5% up by 5.7 pp YoY

- PAT at Rs 945 crores jumped 3x, YoY

- EPS for the year improved to Rs 124.1, last year Rs 26.0

- Dividend on equity shares at Rs. 7.50 per share

Mr. Ajay Kapur, Whole Time Director & CEO, ACC Limited, said, “We continue to solidify our position as a frontrunner in the cement industry. Our financial performance with jump in EBITDA by 138% during the year is a testament to the flexibility and strong foundation of our business model. The trust of our customers and our commitment to building a sustainable future with investment in efficiency improvements, green power etc. has furthered our success, as we emerge even stronger than before. With passing time ACC is getting younger and stronger with the expansion and performance efficiency plans”

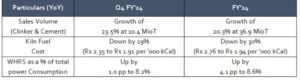

Operational Highlights:

- Kiln fuel cost improved with change of fuel basket and higher consumption of alternative fuel.

- 3 MW of WHRS at Ametha commissioned in Q3 FY’24. Work on WHRS facility at Chanda (18 MW) & Wadi (21.5 MW) is on track and will be commissioned in Q2 this year, which will help to take total capacity to 86 MW or 25% of total power.

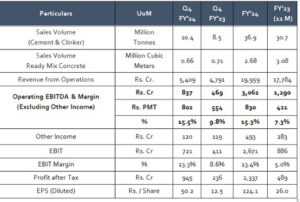

Financial Highlights:

- Significant improvements in all financial matrices. Revenue growth at 13%; Operating EBITDA up 79%, EBITDA margin up from 9.8% to 15.5%.

- A total of Rs. 1,044 Cr cash flows generated from the Operations in Q4, Rs. 2,995 Cr in FY 24. Cash & Cash equivalent at Rs. 4,667 Cr, Consolidated Net Worth at Rs. 16,333 Cr, up by Rs. 2,191 Cr from FY’23. Business Working Capital is amongst the best in comparison with peers and stands at 13 days cycle.

- EPS(Diluted) Rs. 50.2 in Mar’24 quarter, compared to Rs. 12.5 in Mar’23 quarter.

Consolidated Financial Performance for Q4 and FY 2023-24

Dividend

Dividend

In context of the ongoing capex and growth plans of the company, the Board of Directors have recommended a dividend on equity shares at Rs. 7.50 per share, which is consistent with last year dividend on 12 months basis.