NE BUSINESS BUREAU

CHENNAI, MAY 9

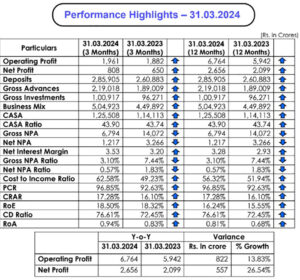

Public sector banking major Indian Overseas Bank (IOB) on Thursday its highest-ever net profit of Rs 808 crores for the fourth quarter, a 24% increase, against Rs 650 crore in the same quarter last year and Rs 2,656 Crores for the fiscal year ending March 31, 2024. Demonstrating robust financial performance, the bank’s operating profit for the year grew by 13.83%, accompanied by a remarkable 26.54% increase in net profit.

“A key highlight of the fiscal year was exceptional control over slippages, with only Rs.1517 crores slippages, accounting for 0.87% of performing advance as on 31.03. 2023. Total recovery recorded at Rs.4,549 crores as of March 31, 2024, improving Gross NPA by more than 50% to 3.10% as against 7.44% as on 31.03.2023,” the bank said.

- Net NPA has improved to 0.57% as on 31.03.2024 as against 1.83% on 31.03.2023

- GNPA ratio has improved to 3.10% on 31.03.2024 as against 7.44% on 31.03.2023.

- The Provision Coverage Ratio recorded at 96.85% (PCR for 31.03.2023 is 92.63%).

- IOB plans to open 88 new branches throughout the year, furthering its reach and accessibility to customers

Interest income for the quarter ended March 31, 2024, improved to Rs 6,629 Crores, reflecting a significant growth trajectory from Rs 5,192 crores. The Net Interest Margin of the bank strengthened to 3.28% compared to 2.93% as on March 31, 2023.

IOB’s total business surged to Rs 5,04,923 crores as of March 31, 2024, with an impressive growth in Current Account Savings Account (CASA) by 43.90%.

Affirming its commitment to expansion, IOB plans to open 88 new branches throughout the year, furthering its reach and accessibility to customers.

Furthermore, IOB continues to prioritize customer-centric initiatives, offering one of the highest interest rates on Rupee Retail Term Deposit for the 444 Days bucket. The bank also introduced innovative products such as the IOB Freedom Savings and Current Account, alongside the launch of the Green Deposit Scheme, reflecting its dedication to sustainability.

In line with its digital transformation journey, IOB introduced three new RuPay Credit Card variants and pioneered online Real-Time Allotment of Safe Deposit Lockers, streamlining the process with Digital Documents Execution (DDE) for seamless online locker agreements. Moreover, IOB initiated savings account portability and UPI QR Code based Interoperable Cardless Cash Withdrawl(ICCW) in our ATM portfolio enhancing customer convenience and flexibility.

As IOB continues its journey of growth and innovation, it remains committed to delivering exceptional value to its customers while maintaining a strong financial performance.