NE NEWS SERVICE

MUMBAI, FEB 5

Reserve Bank of India (RBI) on Friday decided to leave the benchmark interest rate unchanged at 4 percent but maintained an accommodative stance, implying rate cuts in the future if the need arises to support the economy hit by the COVID-19 pandemic.

Also Read:

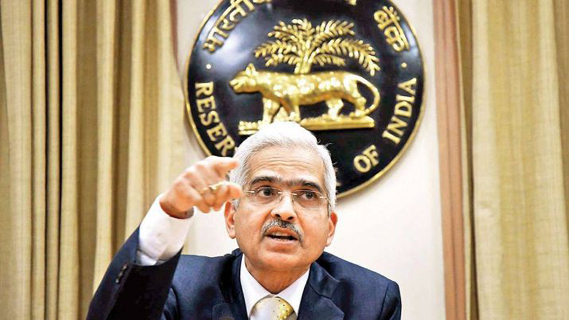

The benchmark repurchase (repo) rate has been left unchanged at 4 percent, Governor Shaktikanta Das said while announcing the decisions taken by the central bank”s Monetary Policy Committee (MPC).

Address by Shri Shaktikanta Das, Governor, Reserve Bank of India https://t.co/Yr2FmWVd30

— ReserveBankOfIndia (@RBI) February 5, 2021

Consequently, the reverse repo rate will also continue to earn 3.35 percent for banks for their deposits kept with RBI.

He said MPC voted for keeping the interest rate unchanged and decided to continue with its accommodative stance to support growth.

The central bank had slashed the repo rate by 115 basis points since late March 2020 to support growth.

This is the fourth time in a row that MPC has decided to keep the policy rate unchanged. RBI had last revised its policy rate on May 22 in an off-policy cycle to perk up demand by cutting interest rates to a historic low.

The 27th meeting of the rate-setting MPC with three external members — Ashima Goyal, Jayanth R Varma, and Shashanka Bhide — began on February 3. This is the first meeting of the rate-setting panel after the Budget 2021-22, announced this week, projected a nominal GDP growth rate of 14.5 percent and a fiscal deficit of 6.8 percent for the financial year beginning April 1.

The government moved the interest rate-setting role from the RBI Governor to the six-member MPC in 2016. Half of the panel, headed by the Governor, is made up of external independent members.

MPC has been given the mandate to maintain annual inflation at 4 percent until March 31, 2021, with an upper tolerance of 6 percent and a lower tolerance of 2 percent.