NE BUSINESS BUREAU

MUMBAI, FEB 6

Days after Union Finance Minister Nirmala Sitharaman presented the annual budget for FY 2020-21, the Reserve Bank of India (RBI) on Thursday kept the repo rate unchanged at the current 5.15 per cent level in am attempt to control the rising inflation. Repo rate is the rate at which the RBI lends money to commercial banks in the event of any shortfall of funds.

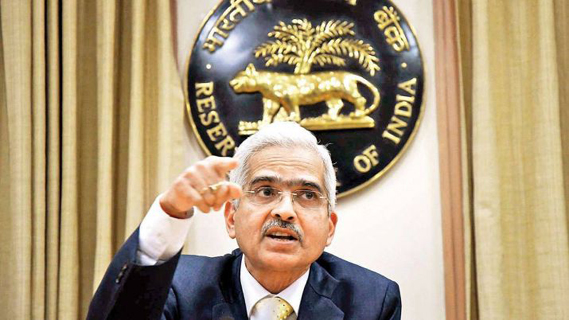

The six-member monetary policy committee (MPC) headed by Governor Shaktikanta Das announced the decision after a three-day meeting, the last of the current fiscal year 2019-20. All MPC members including Chetan Ghate, Pami Dua, Ravindra Dholakia, Janak Raj, Michael Debabrata Patra, and RBI governor Shaktikanta Das voted in favour of the status quo decision.

The central bank also retained GDP growth at 5 per cent for 2019-20 and pegged it at 6 per cent for the next fiscal.

“Economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain the status quo,” the Monetary Policy Committee (MPC) said as reported by PTI.

A repo rate cut allows banks to reduce interest rates for consumers and lowers equal monthly instalments on home loans, car loans and personal loans.

The Reserve Bank of India also revised upwards its retail inflation projection for the last quarter of the current fiscal to 6.5 per cent owing to likely increase in input costs for milk and pulses amid volatile crude oil prices.

Going forward, the inflation outlook is likely to be influenced by several factors like food inflation, crude prices and input costs for services, RBI said.

On food inflation, RBI said it is likely to soften from the high levels registered in December and the decline is expected to become more pronounced during the fourth quarter of this fiscal as onion prices ease following arrivals of late Kharif and rabi harvests, the Reserve Bank of India (RBI) said in its last bi-monthly monetary policy revealed on Thursday.

Besides, crude prices are likely to remain volatile due to unabated geopolitical tensions in the Middle East on one hand, and uncertain global economic outlook on the other. Moreover, there has been an increase in input costs for services, in recent months, it added.

This is the first policy announcement from RBI in 2020. The RBI MPC considers CPI inflation for its monetary policy actions and inflation is expected to be within the comfort zone of the MPC in the next fiscal.

“Taking into consideration these factors, and under the assumption of a normal south-west monsoon in 2020-21, the CPI inflation projection is revised upwards to 6.5 per cent for Q4:2019-20 (January-March 2020); 5.4-5 per cent for H1:2020-21 (April-September 2020); and 3.2 per cent for Q3:2020-21 (October-December), with risks broadly balanced,” RBI said.

The RBI had slashed interest rates by a cumulative 135 basis points this fiscal, making it the world’s most aggressively easing major central bank. The government expects economic growth at 5 per cent for the current financial year, far slower than the 2018-19 expansion rate of 6.8 per cent.

This is mainly due to weak household spending, muted corporate investments, and a crippling slowdown in manufacturing and construction activity.

The recent status-quo on the repo rate is the second consecutive pause by the RBI after slashing the policy rates by 135 basis points in five back-to-back reviews in 2019. In December last year, the monetary policy committee of the RBI had surprised everyone by pausing the repo rate despite the forecast of a rate cut by the economists.

Bekxy Kuriakose, Head – Fixed Income, Principal Mutual Fund welcomes RBI policy

Commenting on the RBI policy, Bekxy Kuriakose said, “As expected the RBI MPC kept key repo and reverse repo rates unchanged and retained stance at “accommodative” with a 6-0 vote. Inflation forecast for H1:2020-21 has been revised upwards by nearly 140 bps (earlier was 4.0-3.8) and now (5.4-5.5). The real GDP growth forecast, on the other hand, has been revised downwards to 5.5% – 6.00% in H1:2020-21 from 5.9%-6.3% earlier.

The most significant statement in the policy was that policy recognizes that “ there is policy space available for future rate action” and that “persevere with the accommodative stance as long as necessary to revive growth, while ensuring that inflation remains within the target”. This would be recognized by the market as a dovish stance.

In the Statement on developmental and regulatory policies, the most important announcement was Long Term Repo Operations for improving monetary transmission. As expected RBI is now increasingly focusing on improving monetary transmission especially wrt bank credit to productive sectors. In the press conference later, the governor indicated that these LTROs of 1 yr and 3 yr maturity worth Rs 1 lakh crores would be available at the repo rate. This is a bold measure and should help banks to kickstart credit growth in these tenors and help to reduce their cost/improve margins. This measure has led to a sharper rally in the short end of the gilt yield curve post-policy where yields have fallen in the 2-4 yr segment by 10 to 15 bps.

The overall policy is positive for debt markets with the dovish stance and LTROs introduced. In the near term lack of fresh supply, expectations of continued Operation Twist would support short to medium gilt yields and corporate bond yields. With ample banking system, liquidity money market yields would remain benign.”