NE NEWS SERVICE

CHENNAI, DEC 7

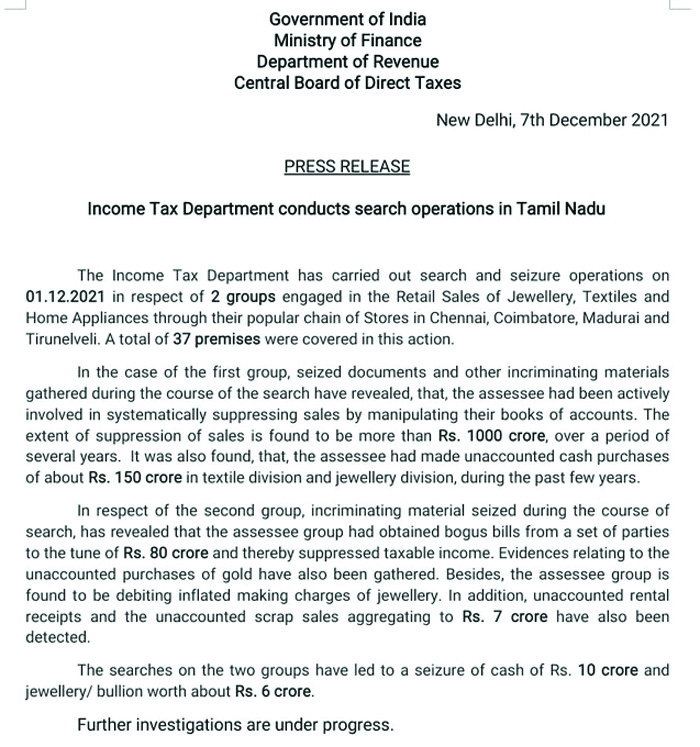

The Income Tax Department conducted search and seizure operations against two Tamil Nadu-based groups where the tax department uncovered undisclosed income over Rs 1,000 crore.

These two companies are engaged in the retail sales of jewellery, textiles and home appliances through their popular chain of stores in Chennai, Coimbatore, Madurai and Tirunelveli.

The raids were conducted on December 01, 2021, across a total of 37 premises, CBDT said in a statement on Tuesday.

In the case of the first group, seized documents and other incriminating materials gathered during the course of the search revealed that the assessee had been actively involved in systematically suppressing sales by manipulating their books of accounts, the direct tax authority said.

The extent of suppression of sales was found to be more than Rs 1,000 crore, over a period of several years. It was also found, that, the company had made unaccounted cash purchases of about Rs 150 crore in textile division and jewellery division, during the past few years, CBDT further mentioned.

After searches against the second group, incriminating material seized during the course of search revealed that the assessee group had obtained bogus bills from a set of parties to the tune of Rs 80 crore and thereby suppressed taxable income.

Evidences relating to the unaccounted purchases of gold against this group were also gathered, CBDT informed. Besides, the assessee group is found to be levying inflated making charges of jewellery. In addition, unaccounted rental receipts and the unaccounted scrap sales aggregating to Rs 7 crore have also been detected.

The searches on the two groups have led to a seizure of cash of Rs 10 crore and jewellery/ bullion worth about Rs. 6 crore.