NE BUSINESS BUREAU

MUMBAI, JUNE 18

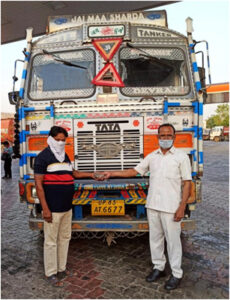

Tata Motors has been working closely with truck drivers and transporters ever since the COVID-19 pandemic-induced lockdown started in India. The truck drivers were given monetary support as well as day-to-day rations for use. Tata Motors identified the existing and emerging pain points in every link of the transport value chain and partnered it to address them in the most effective and efficient manner. In between, the company also extended warranties and service support of eligible trucks as well, a company release said.

Tata Motors has now taken another step, one of giving financial aid to fleet owners. As said by the Reserve Bank of India) (RBI), Tata Motors has extended the moratorium on EMI payment to all its corporate as well as retail customers. Tata Motors Finance, a subsidiary of the Tata Motors Group, has also brought in several schemes to help its customers. These include opex funding, loan restructuring, bill discounts, working capital, low EMIs for new vehicles and more. Such customised finance options, Tata Motors hopes, will allow the fleet operators to have essential cash flow and help them in their business.

Speaking about the initiatives undertaken, R. Ramakrishnan, Global Head – Customer Care, CVBU, Tata Motors Limited said, “Truck drivers and transporters are frontline heroes as they have played a stellar role in ensuring that the wheels of the nation are kept running with seamless transportation of all supplies. Being India’s leading commercial vehicle manufacturer, a majority of them use our vehicles and we are their first port of call for assistance. In these unprecedented times, we are the committed partner, providing all possible support to them and their vehicles. We have focused our efforts with a holistic approach to making their tough tasks and lives a little easier”

If a customer opts for opex funding, Tata Motors will take care of fixed expenses for the next quarter. Suppliers as well as dealer claim financing will also be handled by Tata Motors. Given that income levels of many MSMEs have dropped in the last 3-4 months, a restructuring of their loans will be done. This will allow them to pay lower EMIs till the time their business as well as incomes go back to normal in the next six to nine months. As for working capital solutions for customers, a vehicle which is loan-free will be kept as collateral with TMF for funding. Payment cycle increase will also be taken care from an average of 45 days pre-COVID to 90 days going ahead.

Credit solutions will help customers get plying time support. If a customer were to buy a new truck, there will be lower EMIs. This will be prevalent only for the first 12 months. Based on requisite collateral, new vehicle loans will be bundled with working capital ones. Developing Credit solutions that will be of immense benefit to retail fleet operators by providing much needed plying time liquidity and credit support. Customers can buy fuel, recharge their fastags, pay for scheduled expenses like vehicle service, insurance, permit-road tax, etc.

Speaking about the novel financing solutions being offered, Samrat Gupta, CEO, Tata Motors Finance said, “Being one of the large NBFCs operating in the country and as a committed captive commercial vehicle financer, our primary focus is to ensure the economic success of all our stakeholders, especially our customers. In the aftermath of COVID, we have extensively engaged with them to understand their immediate challenges better and accordingly develop a range of solutions to address their need for liquidity for immediate survival and near term sustenance. This partnering amidst crisis has strengthened our relationships with our customers for the longer term.”

ADVERTISEMENT

Tata Motors provides support to truck drivers, fleet operators for seamless supplies

Provides food and medical support to truck drivers; 24x7 service and financial assistance to transporters and fleet owners for Low EMIs, loan restructuring and purchasing new vehicles.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT