- Nifty 50 index registered an impressive gain of nearly 20%, while the BSE Sensex delivered returns exceeding 18% over the course of the year

- As the financial landscape transitions into the New Year, analysts at Standard Chartered have upgraded Indian equities to Overweight

- Equities and Bonds are likely to outperform current cash yields on offer

- According to the report, Indian equities continue to be supported, at least in H1 2024, by strong positive drivers

NE BUSINESS BUREAU

MUMBAI, JAN 2

Valuations, earnings, and pre-election optimism to fuel Indian stock market in 2024, says the India Market Outlook 2024 Report curated by the Wealth Management Team at Standard Chartered Bank.

The Indian stock market has delivered commendable returns for investors in 2023, propelled by robust domestic economic growth, resilient corporate earnings, and accommodative monetary policies implemented by central banks amidst subdued inflationary pressures.

The flagship Nifty 50 index registered an impressive gain of nearly 20%, while the BSE Sensex delivered returns exceeding 18% over the course of the year. Notably, the broader markets displayed remarkable outperformance, with the Nifty Smallcap 100 index surging over 54% and the Nifty Midcap 100 recording a robust increase of more than 45% in 2023.

As the financial landscape transitions into the New Year, analysts at Standard Chartered have upgraded Indian equities to Overweight. Their optimism stems from the expectations that equity markets will continue to ride the positive momentum with bond markets offering attractive real yields.

“India’s strong domestic growth momentum, up trending earnings cycle and robust fund inflows are likely to off-set above average valuation premiums. Further, pre-election optimism amid expectations of government and policy continuity, are tailwinds for equities. Within equities, we are overweight large-cap equities given better margin of safety in terms of earnings and valuation. We prefer value-style equities,” Standard Chartered said in a report.

According to the report, Indian equities continue to be supported, at least in H1 2024, by strong positive drivers. Here are the factors:

Superior profit cycle

India’s earnings remain resilient post a decade long down-cycle from 2011-2020. As per Bloomberg consensus estimates, Nifty 50 index EPS is expected to grow by 14% and 16% in FY2024 and FY2025. Overall, EPS growth of ~18 between FY2020-2025, makes the current cycle the best since the 2004-08 period, the report said.

Valuations appear more reasonable

India’s market capitalization crossed the $4 trillion mark in 2023, as domestic equity indices scaled new all-time peaks. Despite the strong gains, Nifty Index’s 12-month forward P/E ratio is at 19.8x, lower than the 2021 peak of 23x. According to the analysts at Standard Chartered, Indian equities valuation premium to peers is justified given superior GDP growth and earnings delivery.

Low foreign investor positioning and strong domestic flows

The inflows from foreign portfolio investors (FPI) in the Indian equity market has remained strong. However, despite strong inflows, foreign ownership of the BSE 200 index market is at decadal lows of around 18%. Meanwhile, domestic flows remain strong on greater adoption of financial assets and robust systematic investment inflows in mutual funds.

Pre-election optimism

Analysts also believe domestic growth in H1 2024 is likely to get a boost from an acceleration in consumption demand through election related spending. Investment growth could pick-up in H2 2024 with an acceleration in private spending as the new government’s policy priorities become apparent.

In addition, India is relatively less exposed to global macro risks emanating from slower global growth, still elevated interest rates and greater geo-political uncertainty; given its large domestic growth base and improving external position, the report added.

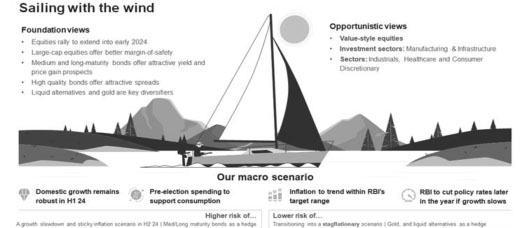

In foundation allocations, Standard Chartered is Overweight on equities, with 2023 strong performance extending into H1 2024, supported by strong earnings delivery and pre-election optimism; Overweight on medium/long-maturity bonds, as yields gradually move lower; and Overweight on large-cap equities given greater margin of safety.

Equities and Bonds are likely to outperform current cash yields on offer, it said.

In opportunistic allocations, it prefers value-style equites, investment sectors – manufacturing and infrastructure, and barbell-like sector positioning with Overweight on Industrials and Consumer Discretionary balanced with an Overweight on Healthcare.

However, risks to its positive equity view include global growth slowdown and probable downgrades of earnings expectation; above average equity valuations, both absolute and relative to peers; and foreign investor selling amid slowing domestic